An Unbiased View of Investment Advisors

Table of Contents5 Easy Facts About Investment Advisors DescribedSome Known Questions About Investment Advisors.

One typical mistaken belief is that retirement life profiles are guaranteed. However, this is actually not the case. While some systems give insurance policy for retired life accounts, including the FDIC for money market accounts and also the SIPC for broker agents, these programs merely guard against reduction as a result of breakdown of the establishment, not versus loss as a result of market ailments. Numerous consider their 401( k)a promised retirement life cost savings program. However, that isnot the certainly not. A 401 (k)is an employer-sponsored pension that enables employees to provide a section of their income to a tax-deferred profile. investment advisors. The cash in the profile can then be actually purchased different securities, including equities, guaranties, and also mutual funds. The account worth are going to fluctuate relying on the efficiency of the expenditures. For these reasons,

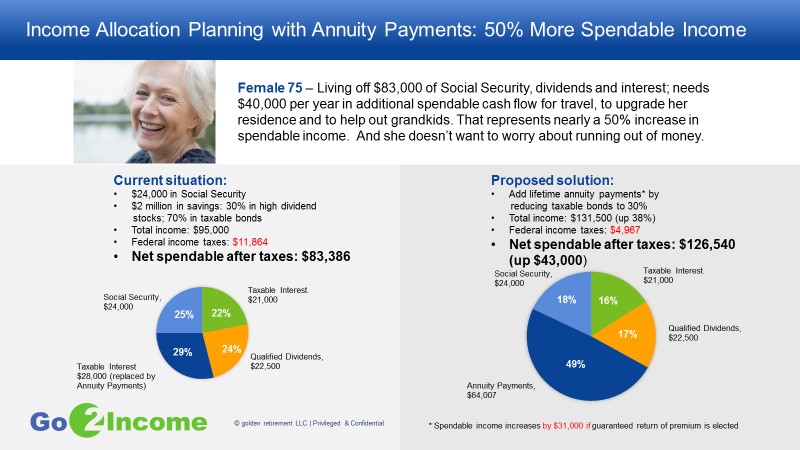

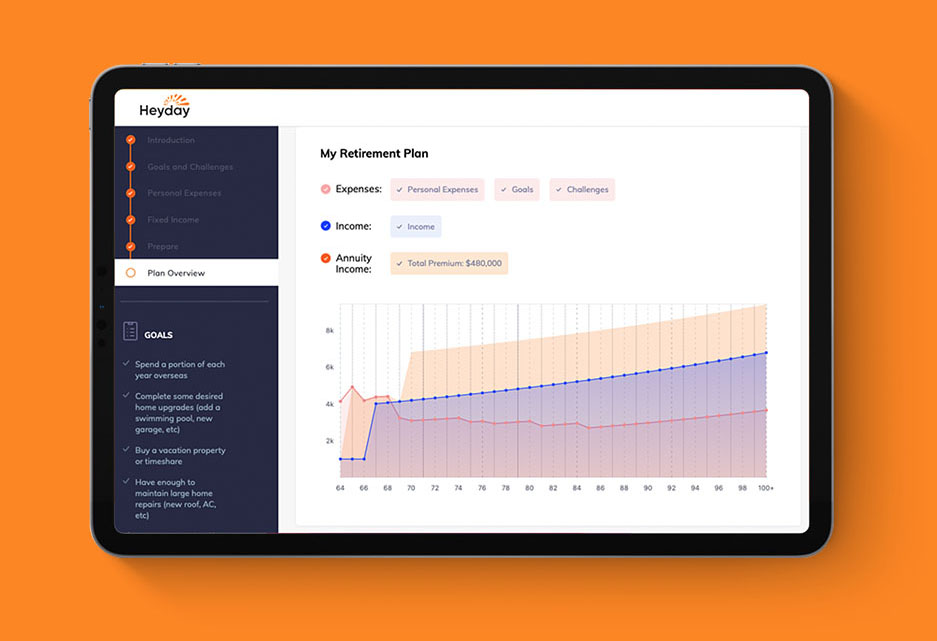

it is crucial to understand that a 401 (k)is actually not a guaranteed retirement consideration. Nonetheless, it can easily still be a valuable resource for developing your savings. Pensions are actually usually disregarded as retired life planning resources, but they provide many distinct perks that can easily be actually incredibly beneficial to retired people. Second, allowances are tax-deferred, so you will definitely not need to spend normal income tax on your expenditure until you acquire payments. Ultimately, annuities give survivor benefit and also spousal advantages that can easily aid to offer monetary security for your adored ones. For these explanations, allowances are typically looked at the absolute most protected retired life planning. If you are actually looking for a risk-free assets profile that are going to provide a guaranteed income flow, an allowance along with a life time profit motorcyclist view publisher site is the method to go. Using this form of allowance arrangement, your remittances are guaranteed no matter the length of time you reside, so you can easily feel confident that your retirement life financial savings will certainly never ever end. Through this form of pension, your interest is actually assured for Full Report a set time frame, so you understand exactly the amount of cash you'll earn yearly. If you are actually looking for an investment that possesses the potential to develop over time, a fixed mark annuity is actually the ideal choice for you. Index allowances perform certainly not lose loan to market volatility and also should certainly not be perplexed along with a variable pension (which may lose funds ).

Little Known Facts About Investment Advisors.

These workplace retirement life plannings take advantage of an allowance arrangement to offer life time revenue to retired employees. Pension plan benefits can be actually a significant retired life revenue source, and conventional pension account programs are typically one of the very most charitable income sources accessible. There are an amount of inquiries that need to have to be addressed when you are actually organizing retirement life income.